What Is Portfolio Income and How It Can Work for You

Portfolio income refers to the money generated from investments such as stocks, bonds, and real estate.

It should not be confused with earned income or employment-based earnings because it has the potential to grow over time even without active work participation.

This type of income can contribute significantly towards attaining financial stability and building wealth.

In this article, we will walk you through understanding portfolio income by discussing its sources and effective strategies for maximizing its benefits.

Portfolio income refers to the money generated from investments such as stocks, bonds, and real estate.

It should not be confused with earned income or employment-based earnings because it has the potential to grow over time even without active work participation.

This type of income can contribute significantly towards attaining financial stability and building wealth.

In this article, we will walk you through understanding portfolio income by discussing its sources and effective strategies for maximizing its benefits.

Key Takeaways

Portfolio income can be obtained from various investments including stocks, bonds, and real estate, and can offer financial stability and the potential for wealth compounding without the need for continual effort.

It's important to consider the tradeoffs of different income generating investments in order to strike the right balance between risk and return.

Portfolio Income is different than capital appreciation. As such, it may behoove investors to work with a financial advisor in order to understand tax implications, risk management, and the investment opportunities that are involved in constructing a portfolio that kicks off income.

Table of Contents

What is Portfolio Income?

The Building Blocks of Portfolio Income

Active and Passive Earnings

How Portfolio Income is Taxed

Crafting Your Income Portfolio

Using Reinvestment to Assist Growth

Alternative Paths to Portfolio Income

Money Market Accounts and CDs

Limited Partnerships and Real Estate

Financial Advisors and Building Portfolio Income

Frequently Asked Questions

What is Portfolio Income?

Portfolio income is the profit earned from investments such as stocks, bonds, and real estate.

This type of income mainly comes from interest on fixed-income investments like coupon bonds and dividends from stock holdings.

The advantage of portfolio income is its ability to provide financial stability without requiring constant effort unlike employment or business-related incomes.

By using effective investment strategies, one can steadily increase their portfolio income over time, which can lead offer early financial freedom and greater stability in retirement.

The regular monthly earnings produced by these investments can have a significant impact on psychological and financial well-being.

The Building Blocks of Portfolio Income

Stocks, Bonds, Real Estate (Directly held or in the form of REITs), Index Funds (ETFs) and Mutual funds may all provide portfolio income.

Real Estate Investment Trusts (REITs)

A Real Estate Investment Trust (REIT) is a business that invests in rental income producing properties.

Consumers like you and I can purchase the REIT in a brokerage account, and as a partial owner of the company, receive income payments in return for holding shares of the company.

Some of the most common Real Estate Investment Trusts include Public Storage (PSA), Realty Income (O), and Prologis (PLD).

Dividend Stocks (Value Stocks)

Dividend-paying stocks pay dividend income to owners of the company.

Similar to a REIT, you can purchase shares in a company via a brokerage account (Retirement or Taxable account) and as a partial owner, receive dividend payments.

While we go into the tradeoffs of the different investment options in more detail below, it is important to know two things.

Fixed Income (Bonds)

Bonds are interest paying loans to governments or companies.

The government (Federal, State, or Municipal) offers interest payments for a specified length of time in exchange for a loan to the public.

At the end of that specified length of time, your original investment is repaid to you, and you are allowed to keep all the interest income you were paid along the way.

Exchange Traded Funds

An Exchange traded fund is similar to a REIT in that it is a single business entity that is a partial owner of many other business entities, typically in the form of stocks traded on a stock exchange.

When you purchase a share of an Exchange Traded Fund, you are a partial owner in that single business entity which owns MANY businesses.

As such, if that ETF holds many shares of dividend paying companies, you as a partial owner are entitled to a portion of those dividend payments.

There are whole categories of ETF's called Income funds whose primary investing objective is to produce investment income for their shareholders.

Mutual Funds

A Mutual fund is basically an Exchange Traded Fund that has an active manager who is compensated directly for their experience and expertise building a portfolio of companies owned by the mutual fund.

Again, as a consumer you purchase shares in the mutual fund which owns shares in many other companies, making you a partial owner of each of those companies.

If the Mutual Fund's investment objective is to produce income in the form of dividends owned by its portfolio companies, you as a partial owner will receive income payments as a partial owner.

Mutual Funds typically have higher fees to compensate for the fact that the fund is actively managed by a human being.

Disclaimer

Choosing the appropriate investment among the options listed above requires skill, experience, and knowledge.

If you are interested in constructing an income generating portfolio with your saved assets, please consult with a fee only fiduciary financial advisor who has experience in this realm.

You can schedule a consultation with our fee only fiduciary team here.

1) As part of the trade off for the stream of income you receive as an owner of any of the above companies, the larger the income or dividend payment, the less capital appreciation you will likely see in the value of the company's shares.

2) Income paid for ownership of shares of a company or REIT may be taxed in various manners. It's important to understand the ways these income sources will be taxed when constructing an income portfolio.

Diversification & Managing Risk

Holding a blend of the above options can provide diversification protection, also known as capital preservation.

Diversification refers to spreading your portfolio asset allocation among many investment options so that if one investments value were to crater, only a small portion of your investment funds would be effected.

Diversification also allows you to benefit when particular investments perform better than others.

Were you to be too concentrated in one position, you might miss opportunities in other investments because you do not have a portion of your investment funds allocated to it.

While the goal of an income portfolio is to produce investment income without needing to contribute labor in exchange for those funds, it is not entirely true that this can be an entirely passive endeavor.

There is still risk involved in owning an income portfolio, and your job as the owner/manager of an income portfolio becomes risk management - making sure that you protect that income stream.

Components of Portfolio Income: Active and Passive Earnings

Portfolio income can be divided into two types: active income, also known as earned income, and passive income.

Active income involves a trade of labor hours for dollars (a job).

Passive income is money received from sources that require little effort to maintain, such as rental payments or royalties.

It is characterized by stability and longevity since these passive income sources typically continue generating revenue without much additional work once they are established.

Some financial experts classify portfolio income as a form of passive income due to its minimal activity requirement for sustainability. This helps differentiate it from active forms of earning (such as labor!), which involve more hands-on management and involvement in business operations.

Understanding the differences between various types of incomes like passive and active plays an important role in selecting suitable investments and strategies aligned with one’s financial goals.

Tax Implications: Understanding How Portfolio Income Is Taxed

Managing taxes for portfolio income can be complex, particularly in relation to capital gains.

A capital gain is the profit earned from selling an investment or asset at a higher price than its original cost and is subject to taxation under special capital gains tax rates. The profit is the capital gain.

Let's illustrate this with an example.

Say you buy 1 share of a stock for $10. You then sell it 6 months later for $14. The $4 profit is the capital gain which is subject to capital gains taxes.

Your original investment of $10 is NOT TAXED in this scenario. (There are exceptions to this, for example when investments are sold for a gain in a retirement account.)

Capital Gains tax rates are generally lower than income tax rates, and vary state to state.

In addition, capital gains tax rates are split between short and long term capital gains.

Finally, depending on the type of investment held, how long it has been held, the income stream may be taxed in it's own unique way.

It's important to understand the myriad of ways your portfolio will generate income that may be taxed in order to accurately estimate how much AFTER-TAX income you will actually produce with the portfolio.

Consult with a tax advisor or financial planner if you have an income portfolio but don't know the exact tax implications of the income it produces.

Click here to schedule a free consultation with our fee only fiduciary financial planning team.

Crafting Your Income Portfolio

Diversifying an income portfolio is crucial for managing risk and optimizing returns.

By spreading investments across various asset classes, industries, and companies, the impact of individual underperforming assets on the overall portfolio can be minimized while also taking advantage of multiple streams of income.

Significant research is involved to find stable companies that produce reliable, steady dividends without significant variability in the price of the company.

An 8% dividend yield is not necessarily a great investment if the underlying company depreciates by 20%!

So be careful to use the stated yield of the investment as the only criteria by which to evaluate the investment.

We like to look at the following criteria when evaluating an investments place in our income portfolios:

1) Tenure - how long it has been able to produce a reliable, predictable monthly income stream

2) Stability - how stable is the price of the underlying investment

3) Tax composition - how will the proceeds be taxed

4) Interest rate sensitivity - how sensitive is the underlying investment to changes in interest rate

5) Fundamentals - how fundamentally sound is the underlying business that we would be investing in.

Combining these 5 criteria with sound risk management strategies like diversification, reinvestment, and strategic rebalancing will result in a fundamentally sound income portfolio.

Using Reinvestment to Assist Growth

You can simulate a compounding effect with income producing investments by "reinvesting" dividends and income back into the initial investment.

Reinvesting offers various advantages such as easy setup and commission-free transactions, along with the ability to purchase fractional shares and quickly utilize available funds.

By consistently reinvesting income from their portfolio, individuals have a steady path towards accumulating wealth over time despite potential risks of lower returns if they are reinvested at a lesser rate.

To be clear - if you opt for reinvesting the income into the initial investment, you will be foregoing actually receiving the income generated!

You cannot do both at the same time, so it is important to align your reinvestment decision with your financial planning goals.

If you'd like to align your financial goals with a plan to help you achieve them, and would like to explore whether an income portfolio may be a part of that, schedule a free consultation with our fee only fiduciary financial planning team.

Alternative Paths to Portfolio Income

There are various avenues to generate portfolio income aside from the conventional options of stocks and bonds.

These include money market accounts as well as certificates of deposit (CDs), which present low-risk alternatives for earning income through investment.

Real estate or commodities have the potential to significantly increase a portfolio’s income by generating funds from sources such as rents and dividends, however these come with greater investment risk and risk management responsibility.

Money Market Accounts and CDs

A money market account, offered by banks and credit unions, typically yields higher interest rates than other traditional savings account or accounts. It is a valuable component in generating portfolio income through regular interest earnings.

The interest rate offered on a money market account is variable and not under your direct control - as bank interest rates approach 0%, so too will money market account interest rates.

In contrast, Certificates of Deposit (CDs) are financial products intended for saving purposes.

They generate interest on a lump-sum deposit that remains untouched for a specific period.

Investing in CDs as part of one’s portfolio income strategy carries the risk of losing purchasing power over time due to inflation.

At the same time, you can "lock in" a guaranteed interest rate for a set period of time, which cannot be done with a traditional money market account or high yield savings account.

Limited Partnerships and Alternative Investments

Limited partnerships offer investors the opportunity to contribute capital to a business entity while maintaining limited liability.

This can result in generating income or loss, which falls under the category of passive income.

Such earnings can be used to increase portfolio income or offset other sources of portfolio income, thereby increasing overall portfolio revenue.

Apart from limited partnerships, there are various alternative investments that also have the potential to generate additional streams of portfolio income including private equity, venture capital, hedge funds and commodities such as art and antiques.

Consult with a qualified financial planner before adding more complex alternative investments into your income portfolio.

The Role of Financial Advisors in Building Portfolio Income

Building an income portfolio can be a hugely rewarding experience.

It can provide long term, predictable, stable income to secure your financial future.

We recommend seeking out qualified financial advisors or financial planners (ideally both!) who can help you create a specific financial plan to help you reach your financial goals.

If an income portfolio is appropriate based on your financial plan, they can help you manage your portfolio income, as well as the investment selection and risk management associated with it.

You can view a series of guides including an Example Financial Plan, A Guide to the 3 Bucket Retirement Strategy, What is a Comprehensive Financial Plan, How are Financial Advisors Compensated.

Click here to schedule a free consultation with our fee only financial planning team to learn how we create unique and individualized financial plans.

Summary

Portfolio income is a valuable tool for attaining financial security and independence.

By utilizing a diverse investment approach that incorporates various assets such as stocks, bonds, ETFs, and alternative investments, individuals can generate a consistent stream of earnings that can greatly contribute to their long-term financial well-being.

With the assistance of professional advisors who understand one’s personal risk tolerance and financial goals, investors can customize their strategies in order to maximize profits and ultimately work towards achieving true fiscal freedom.

Frequently Asked Questions

What is the meaning of portfolio income?

Portfolio income is a type of earnings that includes interest, dividends, and capital gains obtained from investments or loans made. This category does not encompass passive or earned income but may include royalties.

This form of revenue plays a significant role in one’s total earnings. It consists primarily of portfolio equity income, investment returns such as interest on bonds, stock dividends received by investors regularly (quarterly), and annual distributions resulting from portfolio investments.

What is the difference between earned portfolio and passive income?

Portfolio income and passive income are two types of earnings that differ in their source. Portfolio income is generated from stock dividends, interest earned on investments, and profits made from selling stocks. On the other hand, passive income comes from renting out property or receiving royalties for creative work as well as owning shares in limited partnerships.

What are the three types of income?

There are three types of income: earned, portfolio, and passive.

Non-passive income is a small subset of passive income.

Is portfolio income passive for tax purposes?

Income received from one’s portfolio is classified as passive for tax purposes and may be subject to a maximum tax rate of 20%. If an individual has incurred losses through passive activities, these can be used to offset any income generated from such activities.

How do you calculate portfolio income?

Portfolio income is determined by dividing the investment amount for each asset by the total portfolio investment and then multiplying it with its respective weight. This will give you the individual incomes for each asset based on their returns.

If you found the information above helpful, click here to watch my free Masterclass training that explains how you can increase your income in retirement by up to 30% and avoid running out of money in retirement.

Strategic Vs Tactical Asset Allocation

Modern retirement investing strategy is dictated almost entirely by a concept called Asset Allocation.

Asset allocation is the proportional weighting of the money in your retirement portfolio to specific categories of investments, also known as asset classes.

In this article we will explain asset allocation in more depth and make the case that it is a substandard investment framework that leads to poor retirement outcomes.

Modern retirement investing strategy is dictated almost entirely by a concept called Asset Allocation.

Asset allocation is the proportional weighting of the money in your retirement portfolio to specific categories of investments, also known as an asset class (asset classes).

Asset classes can be broken into two categories - “Equities”, or stocks, and “Fixed Income”, or bonds.

From there, Equities can be further broken into sub asset classes like growth stocks, value stocks, small cap, large cap, or international.

Fixed Income can be broken down further by the length of the bond, or the issuer of the bond (think 3-month vs 5 year, or US vs. International).

In this article we will explain asset allocation in more depth and make the case that it is a substandard investment framework that leads to poor retirement outcomes.

Short Summary

Asset allocation is a framework that helps guide retirement investment decisions.

Asset allocation refers to the proportion of your retirement funds that should be invested in a particular investment category.

Asset allocation does not provide any detail about individual investments volatility, potential risk, or income produced.

As such, relying on asset allocation alone to make prudent retirement investment decisions can lead to catastrophic retirement portfolio outcomes.

Table of Contents

Asset Allocations and the "Buy and Hold Strategy"

Tactical Asset Allocation vs Strategic Asset Allocation

What is a Strategic Asset Allocation?

What is a Tactical Asset Allocation?

Why We Believe Tactical Asset Allocation is Superior to Strategic Asset Allocation

What is an Asset Allocation Fund?

Target Date Fund

Asset Allocation Fund

The 3 Fund Portfolio

How Asset Allocation Strategies Fall Short When Informing Retirement Investing Strategies

Frequently Asked Questions

Asset Allocations and the "Buy and Hold Strategy"

An asset allocation is an investment framework that tells you exactly what percent of your retirement money should be invested in what types of investments.

Asset allocations use historical investment performance data to provide these categorical guidelines.

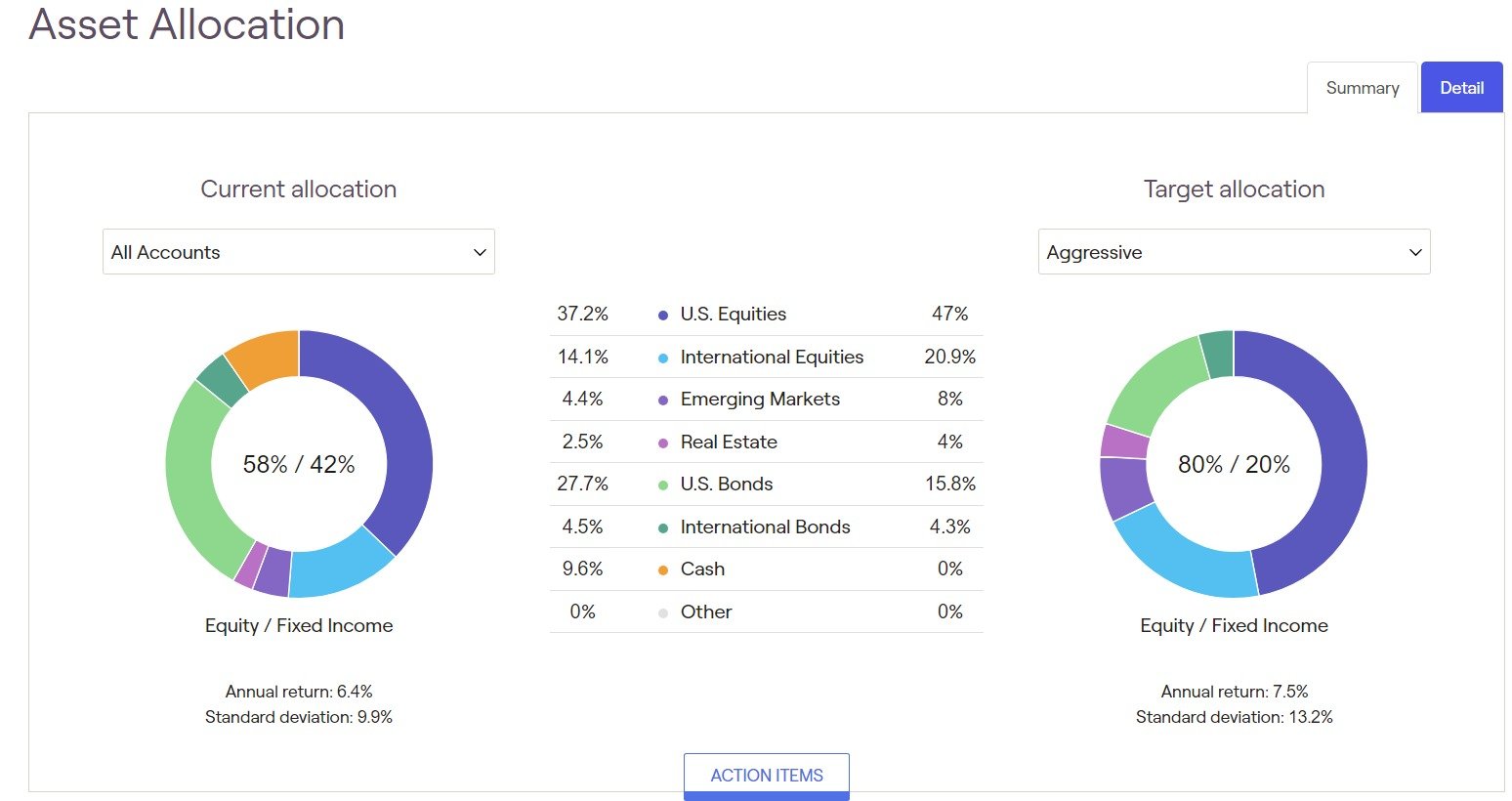

In the image above, you can see that the example “Aggressive” asset allocation recommends 47% of funds in US Equities, 20.9% in International Equities, 8% in Emerging markets, and so on.

The important thing to note is that it provides CATEGORICAL guidelines without providing any direction into the actual investments that will comprise that 47% of US Equities, or that 20.9% of International Equities.

It is left to you as the investor to then make decisions regarding which individual investments to purchase that will comprise those percentages.

The prevailing wisdom is to combine your investment objectives with an appropriate Asset Allocation (as the broad guideline) and then invest in low-cost Index Funds (Exchange traded funds - ETF’s) or mutual funds when constructing your retirement portfolio.

Index Funds are investments that hold many investments within them.

The idea being that the manager of the Exchange Traded Fund or Mutual Fund has the professional experience to choose the right individual investments, so if you can pick the right ETF or Mutual Fund (pick the right manager) then you don’t need to be the expert on investment selection yourself.

In this scenario, all you need to do is pick funds that match your desired asset class (or asset classes) and thereby do not need to be responsible for the selection of individual companies.

The “Buy and Hold” Investment Approach

The combination of Asset Allocations and low-cost index funds (ETF’s/Mutual Funds) allows for a “buy and hold” investment strategy.

The "buy and hold" approach claims that because historically financial markets have “always” appreciated over time, that if you simply choose the right investment mix based on historical performance (asset allocation) and then hold the investments long enough, they will go up in value.

The idea is to buy and hold and do your best to ignore market conditions, economic events, or negative news - because over long enough periods of time investments ALWAYS go up in value.

Yes - over short periods of time (such as 2008, 2020, 2022) your retirement portfolio may go down in value.

But if you can just ride it out, those losses will recover and be negated by the eventual long-term growth.

At Peak Financial Planning, we wholeheartedly disagree with this concept.

While we do believe there is some merit to the use of asset allocation, we believe there has been a sophisticated propaganda effort aimed at consumers just like you and me.

This propaganda effort is designed to CONVINCE us that a buy and hold, asset allocation strategy is the best method when in fact the ACTUAL investment performance of retiree’s just like you do not support this.

Over the 15ish years that the buy and hold investment strategy has prevailed retirement outcomes have worsened.

The buy and hold strategy has also enabled brokerage companies and financial advisors to become lazy.

No longer are financial advisors actually investment experts. They are now just sales people who’s sole job is to gather investment money without actually being an expert at investing that money!

To illustrate this, we will begin by explaining that there are actually two distinctly different approaches to asset allocation, the Strategic Asset Allocation approach, or the Tactical Asset Allocation approach.

These philosophies use the same foundation of asset allocation as a strategic guideline for your investment money.

But from there they completely disagree with each other on the method of executing and managing the ensuing investment portfolio.

Click here to schedule a free no obligation consultation with our Fee Only Fiduciary Financial Planning team.

Tactical vs Strategic Asset Allocation

Tactical and strategic asset allocation are competing philosophy’s that recommend different levels of involvement in managing one’s retirement portfolio.

Those that believe in the strategic asset allocation philosophy follow a longer term buy and hold investment strategy.

Those that believe in the tactical asset allocation philosophy believe in taking a more active hand in the management of their retirement investments.

What is a Strategic Asset Allocation?

Strategic asset allocation recommends ignoring short/medium investment market performance.

Instead, historical data claims that investment market ALWAYS goes up over long periods of time (periods longer than 10 years).

You would periodically (typically annually) rebalance your retirement portfolio back to the strategic asset allocation risk tolerance as a method of “risk management”.

Rebalancing involves buying or selling investments you already own to bring your portfolio weights (proportions) back to the desired allocation.

For example, the stock portion of your portfolio has risen to 75% of your portfolio value because your top holdings are performing well.

Your goal allocation is a 60% stock/40% bond ratio.

Accordingly, you would take profit (sell) some of your stock holdings and reinvest that profit into bond holdings in order to bring your portfolio back to a 60%/40% ratio.

This more passive approach uses a strategic asset allocation philosophy because you're not selling the stock because you anticipate a shift, you're selling the stock to simply reset your weights in your portfolio's asset allocation.

Therefore, if you have the constitution and discipline to just buy and hold and ride out short term market fluctuations, you will be better off in the long run (because “investments always go up in value”).

For this strategy to bear fruit, you must be able to ride out large market downturns such as the great financial crisis in 2008, Covid in 2020, or the market correction in 2022.

One of the modern attractions of using a strategic allocation strategy is that it is VERY simple.

The process of choosing the appropriate strategic asset allocation involves:

Use a Risk Tolerance Questionnaire to determine your “Risk Score”

Your “Risk Score” will determine a ratio of Equity investments vs Fixed Income investments that should be in your retirement portfolio

Based on that ratio, diversify your investment into low cost index or mutual funds that follow the “rules” of that ratio.

Rebalance your portfolio annually according to your risk tolerance.

Sit and watch your retirement portfolio perform.

Because of it’s simplicity, strategic asset allocation is the predominant strategy in the retirement investing universe.

However, just because it is popular does not mean it is actually the best method.

While using a Stategic asset allocation can have merit for young, extremely disciplined, low anxiety individuals, it is very hard for the average retirement investor to just watch their portfolio crater in value without making reactive changes to their investment portfolio, thus counteracting the entire strategy…

What is a Tactical Asset Allocation?

Tactical asset allocation is a more hands on investment approach that can preserve capital.

Much the same as with a strategic asset allocation, you begin by constructing an asset allocation (investment guidelines) that is supported by historical data.

Then, over your investing lifetime, you would adjust your portfolio weightings in anticipation of, or in response to, temporary economic circumstances or current market trends.

As market conditions change, you would proactively adjust the investments held in your retirement portfolio.

This is a much more hands on approach that takes a proactive approach to risk management.

The tactical asset allocation philosophy prioritizes taking an active hand in preventing downside risk to your portfolio that includes:

Using hedges

Dynamic portfolio weightings

More frequent rebalancing

More active profit taking

More frequent tax loss harvesting.

A tactical asset allocation strategy may recommend increasing the percentage of your portfolio that's in longer duration bonds because of forecasted interest rate cuts or increasing exposure to defensive stocks when expecting economic contraction or recession.

This is different from rebalancing (the primary “risk management” method used in the Strategic Asset Allocation philosophy).

Why We Believe Tactical Asset Allocation is Superior to Strategic Asset Allocation

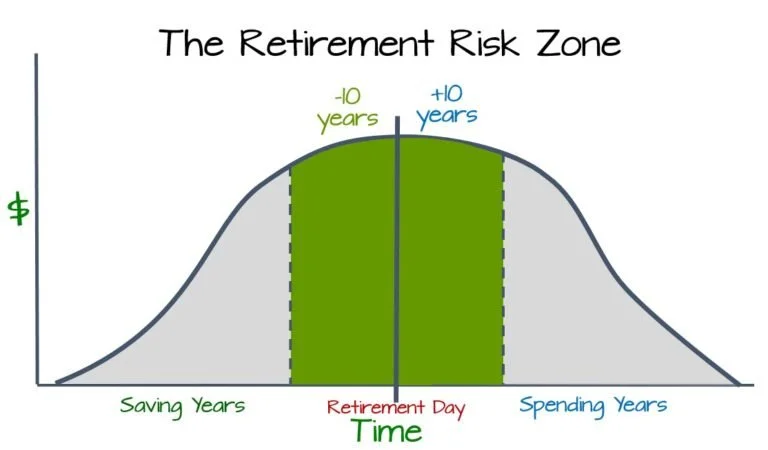

In the strategic asset allocation philosophy, you are told to essentially just “shut up and take your punches” - that because markets go up over time, losses in your retirement portfolio will be made up if you can just sit and wait it out (this is not exactly true - you can watch this video on our YouTube channel where we show why).

The problem with this approach is that you lose TIME.

The one thing you can never recover is time.

Let me illustrate this with an example (here’s an article we’ve written on this exact subject, here’s a video reviewing this as well).

Did you know that in order to recover a 10% loss in your investments value you need an 11.1% gain?

To recover a 20% loss you need a 25% gain.

To recover a 30% loss you need a 42.86% gain.

40% loss requires a 66.67% gain

50% loss requires a 100% gain.

Now the question arises - how long does it take using historic average rates of market returns to actually JUST GET BACK TO BREAKEVEN!

The answer is - for a 10% loss it requires 1.36 years.

For a 20% loss it requires 3.05 years.

For a 30% loss it requires 5.23 years.

For a 40% loss it requires 8.13 years.

For a 50% loss it requires 12.2 years.

When your portfolio returns are negative, you’re not just losing money, you are losing potentially catastrophic amounts of TIME.

Knowing this, we believe that this passive, buy and hold, strategic asset allocation strategy only benefits brokerage companies (who can borrow against your portfolio) and lazy financial advisors (who can charge management fees for essentially doing nothing) AT YOUR EXPENSE.

Click here to schedule a free no obligation consultation with our Fee Only Fiduciary Financial Planning team.

How Big Finance Benefits When We Use Strategic Asset Allocations

We call the “Wall Street, Government, Media” partnership tripod “Big Finance”.

This is because over the past 50 years they have colluded together to increase their economic benefit at the expense of ours, the individual consumer.

Big Finance makes its profit by holding your money.

They lend against your investments, or they charge fee’s for holding the investments, or both.

Therefore, it’s in their best interest to convince you that leaving your money in one place in one format for long periods of time is in your best interest!

On the one hand, Big Finance tells us that investing is simple, that we should use buy and hold, strategic asset allocation investment strategies because history is our guide.

At the same time, Big Finance uses industry jargon, complicated paperwork, and an ever-expanding complicated investment universe to the convince you to have one of their corporate financial advisors manage that “simple buy and hold strategy”.

Big Finance wins either way.

Whether you buy into the fact that investing is simple and manage your own buy and hold strategy on your own, Big Finance profits.

Or if you delegate your retirement portfolio management to a fancy looking suit wearing corporate investment portfolio manager, they charge management fees and profit there.

The issue we have with this system is that Big Finance is not rewarded based on better retirement outcomes!

They are rewarded regardless of whether you as the retiree have better retirement outcomes or not.

Click here to schedule a free no obligation consultation with our Fee Only Fiduciary Financial Planning team.

Additional Areas Asset Allocation Falls Short

Asset allocation alone does not tell us enough about how we should properly invest our retirement money.

First, it falls short in the sense that it is a categorical guide not an actual investment specific guide.

This is a major failing that goes unexplained…

Second, asset allocation tells us nothing about that investments BETA (sensitivity to the overall investment market), Standard Deviation (statistical result range), or historic Maximum Drawdown.

These are key pieces of information that should guide ones investment selection.

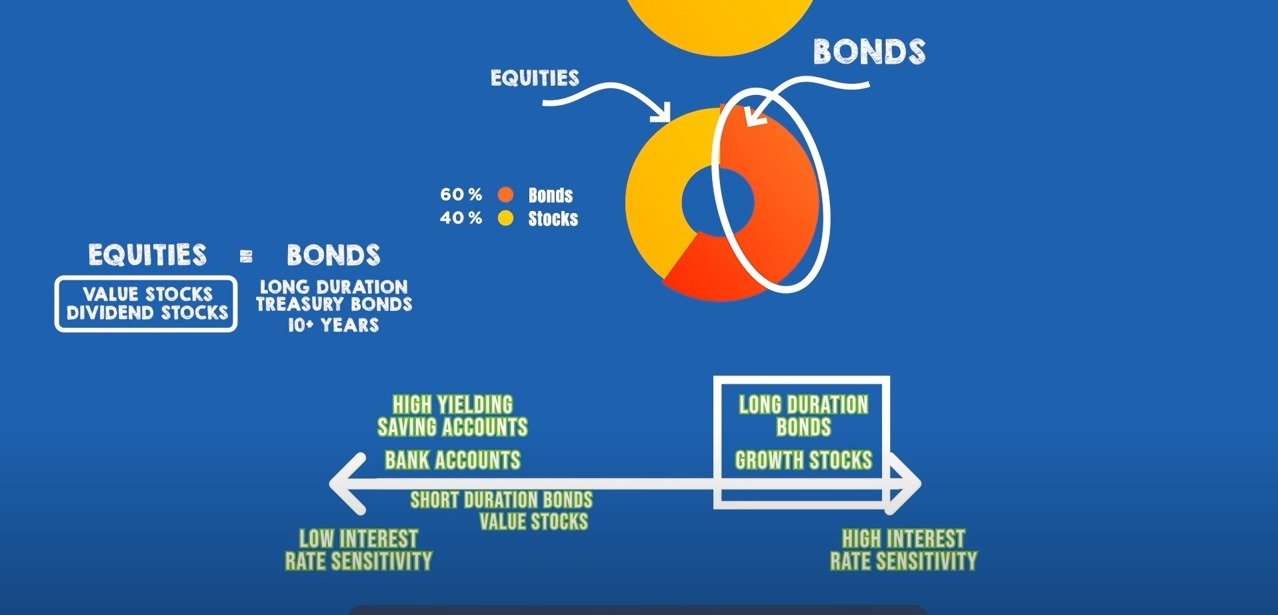

Third, asset allocation tells us nothing about an investments interest rate sensitivity.

Fluctuations in interest rates have a profound but predictable effect on a range of investment types.

For example, bond prices go up when interest rates go down, and bond prices go down when interest rates go up.

This effect is more exaggerated the longer the maturity of the bond (meaning that for 3 month bonds this effect is minimal but for 30 year bonds this effect is extremely powerful!).

This relationship is also true for certain types of stocks!

Growth stock (especially small cap) prices generally go down when interest rates go up, while their prices go up when interest rates go down!

Knowing this, one would (correctly) summarize that growth stocks and long maturity bonds are actually influenced VERY SIMILARLY.

One would also (correctly) summarize that holding long maturity bonds does NOT actually diversify (reduce risk) in your retirement portfolio!

This is just one simple example of how interest rate sensitivity should be factored into the investment selection within your retirement portfolio!

What We Believe

At Peak Financial Planning, we won’t mince our words.

We believe that investing for retirement is COMPLICATED.

We believe that it is a profession just like any other - one that takes years of education, experience, and trial by fire to master.

If someone told you that you could open a business and succeed at it with 2 hours a year invested over 30 years, you would laugh.

Yet that’s the propaganda you are being fed - that with minimal effort you can have your (investment) cake and eat it too (when that is not true IN ANY OTHER AREA OF YOUR LIFE).

We believe that the average consumer (you) is far better served focusing on the behavioral decisions they can control (like building a comprehensive financial plan!) rather than investment decisions that they are not an expert in.

By focusing on things like how much you spend, how much you save, maintaining your health, planning for social security, you can actually have a material, controllable impact on your income in retirement (We have an entire FREE webinar course dedicated to teaching this subject, you can also view a Sample Financial Plan here).

Click here to schedule a free no obligation consultation with our Fee Only Fiduciary Financial Planning team.

FAQ

What is an asset allocation?

Asset allocation guides your portfolio's weighting towards different asset classes with two main choices. Strategic asset allocation is a longer term strategy that considers longer time periods for tactical strategy changes. The target allocations will stay the same and may need to be rebalanced. Rebalancing involves the trades necessary to bring your portfolio weights back to where they should be. Tactical asset allocation decisions are a method of using shorter term shifts to adjust based on market volatility. This is changing your goal allocations, not rebalancing back to the original plan.

What are Asset Allocation Funds?

Asset allocation funds center their strategy around a standardized asset mix that often doesn't account for your needs. The allocation is usually a basic portfolio to minimize the work needed for your investments. Basic funds often come when you have a simple service like a Robo-advisor. Active portfolio management should not fall into this category but it often does.

What is a Target Date Fund

Target date funds change the asset allocation as you near a set time that you determine. Often people select their time horizon to line up with a big expense, such as desired retirement or a child's college start year. As you near the target date, the various asset classes shift from riskier to more conservative. This is supposed to help get you more money when you need it.

What is a Three Fund Portfolio

There is a growing movement, saying we don't need many positions, especially individual stocks. The argument is that index funds are naturally diversified, so we can use say a 3-5 fund portfolio. This strategy would have 1 stock fund, 1 bond fund, and 1 international or emerging markets fund. Ideally allowing us to accomplish what a more complex portfolio would have done.

We don't believe that this is an option. Investors have very specific needs for portfolio based decisions. You can watch a video we made on this here:

https://www.youtube.com/watch?v=AcZTHeR6_UI

What should I use to determine my investment strategy?

More important factors besides plain asset allocation include interest rate sensitivity, portfolio income vs growth, and the goals for your assets as they relate to your financial needs.

If you found the information above helpful, click here to watch my free Masterclass training that explains how you can increase your income in retirement by up to 30% and avoid running out of money in retirement.

What are In-Service Distributions?

In-service distributions, also known as in-service withdrawals, are distributions taken from your employer sponsored retirement plan (a 401 k is the most common example) while you still work for the employer.

From a proactive retirement planning perspective, there are many reasons you might consider taking an in-service withdrawal. There are also drawbacks like the loss of protected benefit from creditors.

In this guide we will explain what in-service distributions are, why to consider them, the rules you should be aware of, and the potential consequences if performed incorrectly.

In-service distributions, also known as in-service withdrawals, are distributions taken from your employer sponsored retirement plan (a 401 k is the most common example) while you still work for the employer.

From a proactive retirement planning perspective, there are many reasons you might consider taking an in-service withdrawal. There are also drawbacks like the loss of protected benefit from creditors.

In this guide we will explain what in-service distributions are, why to consider them, the rules you should be aware of, and the potential consequences if performed incorrectly.

Table of contents:

What is an in-service distribution?

Why would you consider in-service withdrawals?

What are the in-service withdrawal rules?

What are the hardship distribution exceptions?

What is an in-service rollover?

When would you consider an in-service rollover?

Short Summary

In-Service Distributions are withdrawals from employer sponsored retirement plans while still employed with the plan holder.

This can be a useful way to supplement income.

You need to consider the rules and regulations in order to avoid penalties and excessive tax liabilities.

What is an In-Service Distribution?

An in-service withdrawal occurs when a current employee takes distributions from their employer sponsored retirement plan (401 k, 403 b, TSP) while you are still employed with the owner of that plan.

This is not to be confused with an in-service rollover, which is the transferring of funds from your employer's retirement plan to other retirement accounts (for example, a traditional IRA).

You ordinarily wouldn’t take money out of your retirement savings unless you retire because there will be early withdrawal penalties or income taxes owed.

However, an in-service withdrawal may be done without penalties if you are over the certain age for full withdrawal discretion as specified by your plan (or 59 ½ for an IRA). Otherwise, you will need special circumstances to avoid the penalties associated with early withdrawals.

Click here to schedule a free no obligation consultation with our Fee Only Fiduciary Financial Planning team.

Why Would You Consider an In-Service Distribution?

You would consider taking in-service withdrawals for any of the reasons that you would take a regular withdrawal from a retirement account. There are potential benefits, but they should be considered carefully. The biggest factor is your financial goals, long and short term.

Rollovers to an IRA

This is the most common reason for an in-service distribution.

In-service rollovers, follow the normal rollover rules which will be discussed below in the “What is an In-Service Rollovers” section. For now, know that the reasons to rollover while in-service are the same as any rollover to a new account.

Direct Distributions

You may be in need of a direct distribution to cover costs of living. The tax implications of an in-service withdrawal can be quite serious if not planned properly.

One example of this is you and your spouse are different ages. One employee's spouse retires because they are aging. To make up the difference in income, spouse 2 who is still working might start taking in-service withdrawals, or a recurring in-service distribution to supplement income.

If under age 59 ½, you will be assessed a 10% additional tax penalty on withdrawals, in addition to your normal tax on any earnings, or contributions made with pre-tax dollars. The two main exclusions are employee death or employee qualifying disability.

Hardship Distributions

There may be a way out of this early withdrawal penalty if you have special circumstances. Sometimes big or unexpected changes occur in your life that require immediate funding. Here is a list from the Internal Revenue Service (IRS), of life events that qualify for in-service distributions without penalty.

These will be explained in more detail, later on in this guide, under the “What are the Hardship Distribution Expenses” section.

Click here to schedule a free no obligation consultation with our Fee Only Fiduciary Financial Planning team.

What Are the In-Service Distribution Rules?

The rules will vary largely based on your individual plan's rules. You will always want to check with your plan administrator to determine their specific rules. This information can sometimes be found in the plan document, which is a summary of terms and conditions for your plan.

Vesting Periods

Vesting periods can have a large impact on your distributions.

Any one company may have completely different rules from another.

Your employer's contributions, if any, will typically have a vesting schedule.

Vesting is a specified length of time before you actually have ownership of funds that your employer has contributed to your account. The employee contributions will always be immediately vested as that is your money.

You can check your account statements to see the difference in balances.

Vesting occurs via one of three ways:

Graded vesting will be a specific percentage of employer contributed funds that becomes available over time. For example, you gain staggered ownership of 20% more of your employer’s contributions each year.

Cliff vesting will give you full ownership of employer contributed funds as soon as you hit a specific length of time with your employer. For example, you go from owning 0% to all 100% of your employer’s contributions once you have been working with them for 3 years.

Immediate vesting means you will have full ownership of employer contributed funds once they land in the account.

Employer sponsored retirement accounts must give you full 100% vesting of employer contributions, including profit sharing contributions, when the plan is ended by the employer, or you hit full retirement age under your specific plan’s rules (whichever comes first).

Roth Conversions

Some employer sponsored plans will either place a limit on the amount that you can convert to a Roth account, or bar you from converting any of the funds in their plan at all.

Converting from an employer sponsored plan to a Roth IRA or Roth 401k, if offered by your employer, will follow the normal Roth conversion rules. This means you will voluntarily incurred tax on the amount converted, based on your ordinary income tax rates, because qualified plans are funded with elective deferrals in the form of pre tax contributions.

The benefit of conversion is turning deferred taxes, into an immediate taxable portion of "current income", for tax free withdrawals in retirement. This is because Roth contributions are made with after tax dollars.

Loans Against your Retirement Plan

Another method of in-service withdrawal is to take a loan out from your employer sponsored retirement plan.

Payments to principal and interest of loans from your retirement plan go back to your account balance.

You can have multiple loans at once but keep them organized and paid.

You may only withdraw up to 50% of your account value, to a limit of $50,000. There are no other special rules or unique circumstances.

Taxation

A withdrawal before age 59 ½ will require you to pay an additional 10% early withdrawal penalty, on top of the mandatory 20% minimum tax withholding (if you’re withdrawing from a tax deferred account). The exception are loans and hardship distributions.

We recommend you always consult with your tax professional or financial advisor before making an in-service distribution.

Click here to schedule a free no obligation consultation with our Fee Only Fiduciary Financial Planning team.

What are the Hardship Distribution Exceptions?

Certain expenses called hardship distributions. The IRS has deemed these as financial hardship or heavy financial need. The following exceptions are still subject to ordinary income tax as a distribution, but they allow you to withdraw from a retirement plan without the 10% early withdrawal penalty:

Tuition, room and board expenses, and related educational fees for the next 12 months of postsecondary education may qualify for penalty free withdrawals.

Medical expenses not reimbursed by medical insurance, if over a certain percentage of your income.

Up to $10,000 of exemption, once per person’s lifetime, for a first-time purchase of an employee's principal residence. This rule mandates excluding mortgage payments from the cost.

Funeral expenses relating to the employee's family.

Medical care of immediate family.

What is an In-Service Rollover?

An in-service rollover is a rollover performed into a personally directed account such as an (IRA) - while still employed with your original employer. This is often done for more investment options in the short term. Not to be confused with rollovers done after leaving a company.

Why would you consider an in-service rollover?

Flexibility.

Financial flexibility rarely isn't gained from rollovers. The 401-k plan is only one example of employer covered plans. However, plan participants will almost always find more flexibility from self-directed accounts.

This can offer you alternative investment strategies that may enable your financial objectives. Remember that your financial health is more than just investing. Trustworthy financial advisors will balance your investment goals with the rest of your life balance.

IRA’s offer significantly more investment options that enable a broader range of portfolio strategies than available within most 401k plans.

When would you consider an in-service rollover?

You will consider an in-service rollover if you want to start moving funds between accounts without taking a direct in-service distribution. You can move funds from many account types such as a 401 k, profit sharing plan, employee stock plan etc. Consult your financial advisor to ensure things run smoothly.

Click here to schedule a free no obligation consultation with our Fee Only Fiduciary Financial Planning team.

What Considerations Should you be Aware of Before Performing an In-Service Rollover?

Transfer Fees

An existing employer sponsored plan will likely charge you fees (albeit small) for transferring your funds out, usually between $20-$50, that will come from your account balance.

Fund Fees

A 401 k does get favorable fee treatment when buying ETFs and mutual funds.

When investing in mutual funds (and some exchange traded funds) the expense ratios can be higher in an IRA.

(Disclaimer: as long as you do your research, you can find plenty of low/no fee funds, and don’t forget the fact that single stocks and bonds do not have any fees associated with purchasing or holding them).

Advisory Fees

If you plan to perform an in-service rollover in order to work with a professional financial advisor who'll manage your investment accounts, be sure to factor in the advisory fee that manager may charge you for the service.

Investment goals

You hopefully match your values with your investment strategy. Keep in mind retirement planning is entirely different before and after retirement.

Inheriting new responsibilities

If you rollover to an IRA, you will need to manage your investments yourself. This includes monitoring performance, reinvesting cash, and conducting your own research.

Overall financial goals

You should plan with your financial advisor what you would like to achieve with your money. This will include planning for your lifetime, potential heirs, and personal goals. Aligning strategy with your values will increase the odds that you execute on your financial action items and ultimately achieve your financial goals. Click here to see an in-depth sample financial plan.

Click here to schedule a free no obligation consultation with our Fee Only Fiduciary Financial Planning team.

FAQs

Is there a list of companies that may allow in-service distributions?

Here is a list of companies/ plan administrators that will allow you to take in-service distributions without needing a hardship exception (mynacfa.com). This is often a rollover.

Are in-service withdrawals from Roth accounts taxable?

In-service distributions from Roth account contributions will not be taxed, as a normal Roth distribution wouldn’t. But the growth will be taxed should your account balance be higher than your contribution amount.

Are in-service distributions subject to the additional 10% income tax for early withdrawals?

In-service withdrawals are subject to the 10% extra early withdrawal tax penalty if you are under the age of 65 (standard full retirement age), or whatever age your plan considers fully retired.

This does not apply to rollovers as you are not “getting paid” from your retirement account.

Other exceptions to the early withdrawal penalty are the hardship distribution list, which have specific rules.

If you found the information above helpful, click here to watch my free Masterclass training that explains how you can increase your income in retirement by up to 30% and avoid running out of money in retirement.

Should I Roll Over My 401k?

A retirement account rollover is when you transfer your employer sponsored retirement account (401k, 403b, 457 or TSP), or partially move funds from an employer sponsored plan into an IRA. Most retirement account rollovers will occur as a result of leaving a past employer. You will want to take your old 401k with you and retain control over that account. While funds remain in a 401k they are under the control of your previous employer. Funds in an IRA are under your direct control. In this guide we will teach you what rollovers are, when to consider doing a rollover, and how to rollover your account without causing tax mistakes. We will also explain what happens after you perform a rollover, and how to make the process as smooth as possible.

A rollover is when you transfer funds from your employer sponsored retirement account (401k, 403b, 457b or TSP) into an IRA (Individual Retirement Account). Most rollovers happen when you stop working with your employer. If you rollover your old 401 k you retain full control over the account. When funds remain in a 401 k they are under the control of your previous employer. An IRA is independent, therefore, under your direct control.

Remember, all investing involves risk. Remember what your plans and relevant risks are to avoid losing all your retirement savings.

In this guide we will teach you what rollovers are, when to consider performing a rollover, and how to rollover your account without causing tax mistakes. We will also explain what to do after you perform a rollover, and how to make the process as smooth as possible.

Table of contents

What is a Retirement Account Rollover?

Avoid Tax Catastrophes by Understanding Direct vs Indirect Rollovers

How are Rollover Funds Transferred?

Where Can you Rollover Old 401 k Funds to?

Where Should you Rollover your 401 k plan?

Critical Rollover Mistakes to Avoid

What to do Once your Rollover is Complete

What is a Retirement Account Rollover?

Rollovers can come from any retirement plan, including a 401 k plan, 457b, 403b and an IRA. What all of these accounts have in common is that they are all a form of employer sponsored plan. Any contributions to qualified plans, including a traditional account IRA give you the benefit of immediate tax deduction. Keep in mind that all retirement plans involve taking required minimum distributions.

You might perform a rollover for range of reasons: you retire from your employer, you get a new job, you’re unhappy with the current custodian of your IRA, or you want to switch from a 401 k to an IRA for more flexibility. The funds will be rolled over into a new employer's plan or Traditional IRA. You may also roll into a Roth IRA, but we will discuss this further below.

The rollover comes into play when take a full, or partial withdrawal of your retirement savings from the employer's retirement plan and move it to another account.

There are a few ways to rollover your retirement savings, but the bottom line is rollovers are a way to move your money into a different account.

Regardless of the reason, many people perform rollovers and we will clarify what to look out for and how to successfully transfer funds.

Avoid Tax Catastrophes by Understanding Direct vs Indirect Rollovers

When done properly, your retirement savings will get transferred without any tax consequences. If you perform your rollover incorrectly, you could be left with a tax liability that you didn’t expect, or save for.

It’s crucial that you understand the different types of rollovers to prevent making a costly mistake.

Always consult with your financial advisor, and/or accountant to see what makes sense for you. It will always be better to get help performing your rollover and take longer, than rush the asset transfer and incur penalties.

Direct Rollovers

A direct rollover is when you request your former employer's plan custodian (your employer or their third-party administrator) to move the funds directly to another account.

The main example is you retire, quit your job, or decide to fund an IRA (Individual Retirement Account). The first step in that process is to move your old 401 k into an IRA or new employer's retirement plan.

This method avoids any taxation because the funds are directly issued to your new account or plan, for your benefit, and you don’t ever receive the funds as a payment to yourself as an individual person. This is the safest way to perform a rollover. It also ensures that you do not pay taxes for transferring YOUR money. Keep in mind that tax penalty will be charged at ordinary income tax rates.

Trustee to Trustee Transfers:

A trustee is the term for the financial institution holding your retirement account for your benefit. These institutions are called “Custodians” - think Fidelity, Vanguard, Schwab, etc.

You may consider leaving your custodian for the following reasons:

You are unhappy with the quality of customer service

You are paying too much in fees and expenses

You want to consolidate your accounts at one financial institution

A trustee-to-trustee transfer is also known as a direct rollover. A trustee-to-trustee transfer is when you have the trustee of your retirement plan send the funds directly to a new trustee where your account will be custodied.

Once you decide to proceed with a trustee-to-trustee transfer you will ask your current institution to initiate the transfer, or have your new institution send a request for the transfer of funds.

This will require you to have your account numbers, personal information, and account statements readily available to facilitate a smooth transfer.

Indirect Rollover (Also called a 60-day rollover)

An indirect rollover is when your account trustee issues a check directly to you as an individual, rather than directly to your new retirement account custodian. When performing an indirect rollover, it is your responsibility to get in touch with a new trustee or plan administrator. You'll also need to get the funds deposited into another account ASAP.

This should be avoided whenever possible because there can be severe tax consequences if performed incorrectly.

Indirect rollovers have a 60-day time limit to rollover the full amount you elect to withdraw. Here is an example:

When rolling over a 401 k worth $100,000, your plan administrator will withhold $20,000 by default, for your 20% tax liability. The check made out to you will be for $80,000.

The full balance of $100,000 would need to be deposited into your destination (new) accounts (you are now responsible for coming up with the $20,00 withheld) within 60 days to avoid any true taxation.

Any amount NOT deposited within 60 days will be counted in your income taxes, along with an additional 10% penalty for early retirement distributions if you’re under 59 ½ years old.

In this example you would have to use $20,000 from your personal funds to make sure the amount rolled over was $100,000. That $20,000 will be refunded to you next tax season IF you deposit the full $100,000 within 60 days of the original disbursement.

The absolute worst case is withdrawing the $100,000 and not depositing any of it into your new accounts within the 60-days. In that scenario you would owe income tax on the FULL $100,000 as well as an additional potential 10% for early withdrawal penalties, plus your regular income taxes for the year.

Don’t get overwhelmed and avoid the rollover process due to fear of mistakes. Moving a lump sum can be scary, but as long as you understand the process and rules, the process will be straightforward.

If you would like some assistance auditing your financial goals - click here to schedule a free no obligation consultation.

How are rollover funds transferred?

There are two traditional means of transferring your retirement plans from one institution to another.

Those are ACATs and Checks.

No matter the transfer method, you want the transfer to be sent to your new custodian directly, rather than you as an individual.

ACAT - Automated Customer Account Transfer

ACAT stands for Automated Customer Account Transfer. This is the easiest way for your rolled over funds to be sent to their new home. ACAT is the primary and preferred method for direct and trustee to trustee rollovers.

ACATs allow you to transfer your account with your investments intact, no sales necessary. You can also sell your investments to roll over cash, and then rebalance your portfolio as desired.

Keep in mind that with a taxable brokerage account your sales can incur tax liabilities. Sales within a retirement plan will have preferential tax treatment, as sales cause no tax liability unless you withdraw money. This gives the benefit of tax-free growth, within qualified plans, like any IRA account.

Financial institutions will have you fill out a form that requests information including prior custodian, account numbers, and personal identification information.

The destination institution will then send this to the old custodian of your account. The two institutions will review the information and process the ACAT.

Transfer by Check

A transfer by check can be done in two ways:

1. The old plan trustee sends you or your new trustee a check payable to your new trustee. The payee on the check will read something like: “Charles Schwab FBO (For Benefit Of) Joe Smith”. In the description line of the check, you will need to include the destination account number.

This is a trustee-to-trustee transfer. Regardless of where the check gets sent, as long as it is PAYABLE to the new trustee, there is no tax liability.

2.The old trustee of your account sends you a check that is payable to you.

This counts as a taxable distribution meaning you need to follow procedure for indirect rollovers. You need to make sure that you contact the old custodian and ask them to either send a check to your new custodian or reissue you a check payable to the new financial institution.

The check should ABSOLUTELY NOT be deposited into your personal bank account. Even though you intend to move your money from one institution to another this still counts as a distribution in the eyes of the government, incurring withdrawal penalties.

If you take direct payment from your retirement plans then the Internal Revenue Service will want their taxes, and potentially an extra 10% early withdrawal penalty.

Where can you rollover old 401k funds to?

The possible destinations for a rolled over account include:

A new employer’s 401 k

A rollover IRA

An existing IRA (traditional IRA or Roth IRA)

There are reasons to consider each option and we will review them all.

A New Employer 401 k

If you change jobs and want to start a 401 k with your new employer, you need to get in touch with your new HR department and ask for the appropriate paperwork. You will need your personal information, old account information and the desired investment options for your new 401 k.

Consolidating multiple 401k’s can help you simplify organization of your retirement accounts. Joining your new 401 k is a good idea if you expect significant employer contributions. It can also help you simplify your investment selection process, as different 401ks may have different investment options meaning you may need to do different research for each 401 k.

A Rollover IRA

Rollover IRA’s will be the most common option.

A rollover IRA is similar to a traditional IRA:

Rollover IRA’s are available as a traditional IRA or Roth IRA

A traditional 401 k can be rolled into a traditional rollover IRA, and a ROTH 401 k can be rolled into a ROTH rollover IRA.

The same rules of a traditional IRA apply to a rollover IRA including contribution limits (not counting rollovers), investment options, and required minimum distributions (RMD's).

Ability to choose from all the same custodians that offer traditional IRAs.

Keeping money in a rollover IRA will allow you to move funds into a 401k at a future date (for example, if you are between jobs).

An Existing IRA

With that being said, if you move a 401 k into a non-rollover IRA, then you can’t move the funds back to a 401 k. This should be considered if you plan to reenroll in a 401 k at a new job.

Where Should you Rollover to?

This decision depends on your personal retirement goals. Investment advice should come from a source you trust like fiduciary financial planners and your tax advisor accounting for your complete retirement plan.

There are several reasons to roll a 401 k into another 401 k.

Significantly lower fees, including preferential mutual funds or exchange traded funds expense ratios within some retirement plans.

Consolidating 401ks limits the total number of accounts you need to keep track of.

You face fees for closing your old employer plan.

You have pending employer stock options.

Likewise, there are several reasons to roll a 401k into a rollover IRA.

You obtain direct control over the account.

You will have more investment choices.

You may want a financial advisor to manage the account on your behalf.

You can more easily perform ROTH conversions.

In either scenario make sure you perform a DIRECT rollover to avoid being taxed as a full distribution.

Note: When 401 k balances are below $5,000 and you separate from your employer, oftentimes they will require that you roll the funds out of the old plan and into an IRA or to your new employer.

How to Perform Rollovers from Common 401k Administrators

Here are instructions to performing rollovers from 4 of the most common employer sponsored retirement plan custodians.

Regardless of where you're rolling funds out of, you will want to begin with the following steps:

Step 1: Have a destination account opened up at whichever custodian you plan to transfer funds into. This will allow for a direct rollover/ transfer.

For example: if you want to transfer from Fidelity to Schwab, have the proper Schwab account opened before starting. If you want to move from a Vanguard 401 k to a Vanguard IRA, have a Vanguard IRA opened up.

Step 2: Gather account statements that explicitly state your original account number, and your new account's number.

Step 3: Make sure you request a direct transfer from institution to institution to keep things as easy as possible.

To perform a rollover out of 4 of the most common custodians see below for more instructions:

Fidelity 401 k Rollover to Another Company

Call Fidelity’s NetBenefits department from

Mon - Fri, 8:30 a.m. to 8:30 p.m. ET at 800-835-5097

They will ask for personal identifying information and then read you disclosures confirming you want to complete the process.

Vanguard 401 k Rollover to Another Company

Call Vanguard’s retirement client service team from

Mon - Fri, 8:30 a.m. to 9 p.m. ET at 800-523-1188

They will ask for personal identifying information and then read you disclosures confirming you want to complete the process.

Charles Schwab 401 k Rollover to Another Company

Call Schwab’s retirement service team from

Mon - Fri, 8 a.m. to 10 p.m. ET at 800-724-7526

They will ask for personal identifying information and then read you disclosures confirming you want to complete the process.

Principal 401 k Rollover to Another Company

Call Principal’s retirement service team from

Mon - Fri, 8 a.m. to 10 p.m. ET at 800-986-3343

They will ask for personal identifying information and then read you disclosures confirming you want to complete the process.

We encourage you to seek the advice of a fiduciary financial advisor whenever you are attempting a rollover for tax free transfers without hiccups.

If you would like some assistance auditing your financial goals - click here to schedule a free no obligation consultation.

Critical Rollover Mistakes to avoid

Here are the biggest mistakes that you can make when attempting a rollover:

Performing an Indirect Rollover

An indirect rollover can make you pay taxes on 30% or more of your retirement assets if done incorrectly. You can also be pushed into a higher tax bracket should this happen. You also pay immediate taxes on the amount distributed. It is best to avoid this whenever possible.

Not Following the 60-day Rollover Rule

Should you rollover indirectly, the 60-day rule requires that you rollover the entire amount of funds distributed from your retirement plan. If you do not follow this rule, you will owe taxes on the entire amount taken from the plan along with a potential extra 10% of early withdrawal penalties if taken before age 59 ½.

Performing a Rollover on Your Own

Attempting to perform a rollover on your own may leave you with far more questions than you started with.

For example:

Should I switch from a 401 k plan to a traditional IRA?

Should I consolidate my rollover IRA with an already existing IRA?

Should I convert my 401k to a ROTH IRA?

All of these questions depend on your circumstances. You need to consider your personal goals and preferences. Are you looking for estate planning advantages? Does your new plan charge lower fees or add additional fees like a management expense? Does your new plan have a limited menu of investment options?

We recommend working with a financial planner and/or tax advisor, like a CPA, when executing a rollover.

If you would like some assistance auditing your financial goals - click here to schedule a free no obligation consultation.

What to do Once your Rollover is Complete

Account rollovers can take between 2 days and 4 weeks depending on the type of transfer. Once it is completed, here a few things to be aware of:

1.Understand How the Assets Will Settle

The funds can be transferred in two ways:

As cash

This will likely be the case if you rollover a 401 k plan to an IRA

Don’t forget that you will need to reinvest that cash into your chosen securities in order to take advantage of your savings

Assets in kind

This means the investments you owned at your previous institution will be transferred to your new account as they were held

You do not need to reinvest because you own the same securities

Assets like proprietary funds (firm specific mutual funds) will likely be transferred as cash, as they can only be held by their respective custodian.

2.Remember the Early Distribution Penalty on Retirement Accounts

If you don't follow the 60-day rule, or you take a nonexempt distribution at any point before age 59 ½ that doesn’t meet the Internal Revenue Service federal law, you will face a 10% penalty in addition to income taxes.

3.Consider your Stability Needs

Think about what your time horizons before changing investment strategies. Any rollover should be consistent with your retirement plans.

4.Craft your New Investment Strategy

Often times direct rollover transfers from an employer account into an IRA will settle in cash. This provides an opportunity to rebalance your portfolio - without incurring a taxable event!

5.Execute your New Investment Strategy

Rollovers should be executed with the timeline and goals outlined with a trustworthy financial planner. If you’d like to see what a financial plan looks like and how it can inform your decisions, click here to read a sample financial plan.

Schedule a free consultation with us to learn how we can help you build a comprehensive financial plan that works.

FAQ's

What to do with an old 401 k?

You have a few options for an old 401 k plan:

You can keep it with your former employer (If the company is still in business and allows former employees to keep their 401 k)

You can rollover the old 401 k into your new employer's plan

You can start a rollover IRA

You can take the money out as a distribution - the Internal Revenue Service allows penalty free distributions if you leave your job between the ages of 55 and 59 ½ .

This should only be done as an absolute last option if you have a desperate need for money and can’t afford to continue maintaining basic living expenses through other means.

This will be the costliest option as you pay taxes on the distribution unless properly done from a Roth IRA.

Can you rollover a pension?

Yes!

You can make a pension rollover if your your company is ending its pension, and the pension was a qualified retirement plan (contributions are pre-tax dollars and earnings grow tax deferred), OR you are retiring.

If these two tests are met, you may rollover your pension into a 401 k or IRA.

Rolling from a pension into a 401 k is only an option should your current employer be closing its pension system in order to create 401k’s, or you join a new company with a 401 k available.

You can then rollover into an IRA if you go from a pension to a 401 k.

Should you consider consolidating 401 k accounts?

Pros:

You will have easier access to your documents if there is only one 401 k to keep track of

You might find a lower annual fee with a new plan

Less accounts means easier distribution planning

Cons:

You may lose access to proprietary investment choices

Your new plan may have higher fees (flat fees or asset based fees)

You may be required you to sell individual stocks

How long does a rollover take?

In most cases a retirement account rollover can take between a few days to a few weeks depending on the institutions involved and problems along the way like processing paperwork or selling investments.

The direct rollover (trustee-to-trustee transfers will be faster than an indirect transfer).

If you found the information above helpful, click here to watch my free Masterclass training that explains how you can increase your income in retirement by up to 30% and avoid running out of money in retirement.

Is Tax-Loss Harvesting Worth it?

Tax loss harvesting is a method of selling investments for a loss, in order to offset gains from another sold investment, to reduce taxes owed.

When you sell an investment which has appreciated in value from your date of purchase, they become realized gains.

Those realized gains will typically result in a tax burden which can then be reduced by realizing, or selling investments that have reduced in value from the time of your purchase, for a loss.

Tax loss harvesting is a method of selling investments for a loss, in order to offset gains from another sold investment, to reduce taxes owed.

When you sell an investment which has appreciated in value from your date of purchase, they become realized gains.

Those realized gains will typically result in a tax burden which can then be reduced by realizing, or selling investments that have reduced in value from the time of your purchase, for a loss.

How You Can Use Investment Losses as Tax Breaks

Tax loss harvesting can be an effective strategy to reduce or eliminate taxes when you sell an investment with locked in capital gains.

Tax loss harvesting can have multiple benefits.

Lowering your tax burden by offsetting the capital gains.

Enabling you to rebalance your portfolio.

Giving you a carryforward loss for future years.

In this guide, we will seek to explain what tax loss harvesting is, how to do it, and how to determine if it is an appropriate strategy for you.

Need Help with your Financial planning?

I've recorded a free masterclass training video sharing the top strategies financial advisors use to help their clients increase their retirement income and avoid running out of money.

Table of Contents

How Tax Loss Harvesting Works

Which Investment Accounts Can You Tax Loss Harvest In?

Tax Loss Harvesting Rules

Common Tax Loss Harvesting Mistakes - Selling Losers Just to Get the Tax Break

How to Use Tax Loss Harvesting to Your Advantage

Don't Undermine your Personal Investment Goals

Conclusion

FAQs

How Tax Loss Harvesting Works

Ideally with investments, most people hope that their assets will appreciate in value, so that they can buy low and sell high.

But everyone who has invested knows that this isn't how things go 100% of the time. Sometimes we don't have to take the loss or gain, and we can leave them unrealized.

For example:

You buy a stock for $10 and then the price/ value of that stock drops to $5. You have an unrealized loss of $5.

Another case is you buy a stock for $10 and then the price/ value of that stock raises to $15. You have an unrealized gain of $5.

Actually, selling the stock would make that loss or gain realized, and you would then likely owe taxes on that capital gain, should you have gains in excess of losses.

Selling securities for a loss to offset another investment's sale for a gain can decrease the amount of net capital gain (the amount of long term gain minus long and short term loss) or loss (losses higher than gains) that you had for a given year. This is called tax loss harvesting.

The goal is to reduce taxes owed on winning investments by selling investments that will realize losses.

Remember that you have until the end of any tax year to use these benefits for the following term.

There are things you need to consider and keep an eye out for when trying to accomplish this.